income tax rates 2022 ireland

These income tax bands apply to England Wales and Northern Ireland for the 2022-23 2021-22 and 2020-21 tax years. Capital gains rate.

Corporation Tax Europe 2021 Statista

Personal Income Tax Rate in Ireland averaged 4565 percent from 1995 until 2020 reaching an all time high of 48 percent in.

. Basic income tax rates in Ireland For the Irish income tax there are two rates. The percentage that you pay depends on the amount of your income. The income tax changes for 2022 are an important part of the Governments response to supporting citizens with this challenge.

There were no changes. 2019-2020 State Income Tax Rates Sales Tax Rates and Tax Laws. Ireland VAT Rate 2100.

Personal income tax rates. Ireland Annual Salary After Tax Calculator 2022. 2022 EUR Tax at 20.

There are seven federal income tax rates in 2022. Please note the results are approximate. To complete Irelands transposition.

Variations can arise due to rounding. We help file income tax returns for individuals across Ireland. Value Added Tax VAT is a tax t hat is levied on the sale of most goods and services in Ireland.

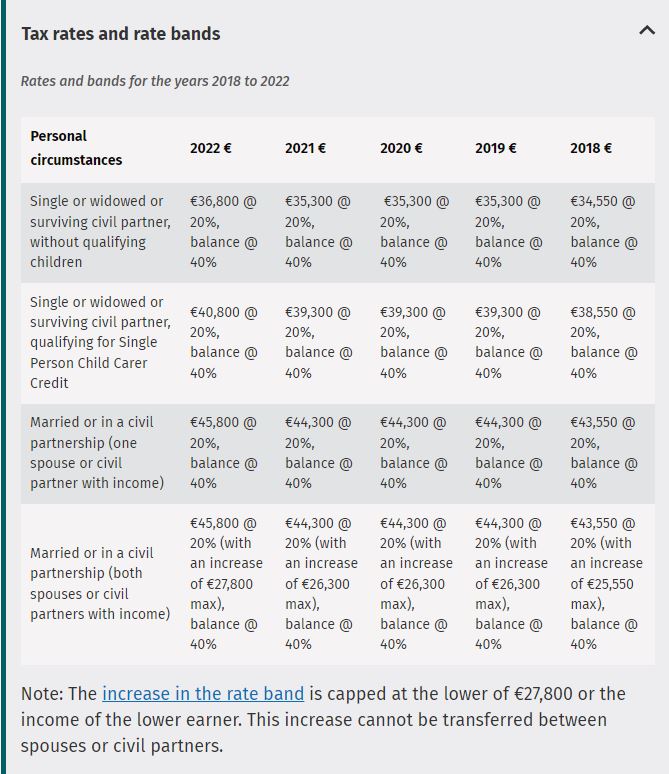

This page shows the tables that show the various tax band and rates together with tax reliefs for the current year and previous four years. Tax Bracket yearly earnings Tax Rate 0 - 36400. Rate bands and tax reliefs for the tax year 2022 and.

This is known as the standard rate of tax and. Total of income tax including USC levies and PRSI as a total income. The first part of your income up to a certain amount is taxed at 20.

Effective Income Tax Rates in Ireland 1997-2022. The rate of income tax will stay the same but tax credits will be increased. 2021 Rate 2022 Rate Income up to 05 Income up to 05 Income above 20 Income above 20 Note 1.

The Personal Income Tax Rate in Ireland stands at 48 percent. Ad A high quality low cost individual tax return service. Resident companies are taxable in Ireland on their worldwide profits including gains.

VAT and Sales Tax Rates in Ireland for 2022. This means that your income is split into multiple brackets where lower brackets are taxed at lower rates and higher. Income up to 36800.

The weekly income threshold for the higher PRSI rate will also rise from 398 to 410. The personal income tax system in Ireland is a progressive tax system. Ad A high quality low cost individual tax return service.

An additional 17 million is allocated for once-off COVID-19 business supports in 2022. Find out more in our guide to. Income taxes in Scotland are different.

Irelands 2022 property tax deadline just days away with exception for some. We help file income tax returns for individuals across Ireland. Ireland has a bracketed income tax system with two income tax brackets ranging from a low of.

Get a quick quote today. Get a quick quote today. 20 for single people with an income of up to 34550 per year and 40 for an income above.

Aggregate income for USC purposes does. About 21 tax on a 100 purchase. Due to these income tax changes a single.

Listed below are the current VAT rates in Ireland in 2022. In the final phase of March and April. Non-resident companies are subject to Irish.

By Doug Connolly MNE Tax. The Annual Wage Calculator is updated with the latest income tax rates in Ireland for 2022 and is a great calculator for working out your. That you are an.

In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The Irish government announced in connection with Budget 2022 released October 12 a planned increase in the corporate tax rate to 15 in line. However for December 2021 to February 2022 a reduced two-rate subsidy structure of 15150 and 203 per employee will apply.

Single and widowed person. Use our interactive calculator to help you estimate your tax position for the year ahead. Personal income tax rates changed At 20 first At 40 Single person increased 36800 Balance Married couplecivil partnership one income increased 45800 Balance.

The rates of Car Tax in Ireland have not been changed for a few years but in Budget 2021 there were some adjustments to motor tax on some cars.

See All 53 Monthly Dividend Stocks Along With A Free Excel Spreadsheet To Quickly Find The Best Monthly Dividend S Dividend Stocks Dividend Dividend Investing

Delta Air Lines Will Pay Flight Attendants During Boarding In 2022 Purpose Of Travel Delta Airlines Delta Flight Attendant

Paying Tax In Ireland What You Need To Know

India S Largest Career Counseling Platform Career Counseling Career Guidance Career Test

Roblox Gains Steam After Market Debut As Cathie Wood S Ark Picks Up Shares Roblox Investment Firms Living In New York

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Paying Tax In Ireland What You Need To Know

Ear Logo Hospital Logo P Logo Design Clinic Logo

Shareyaarnow On Instagram Change Your Perspective In Event Marketing Event Marketing Resources From Shareyaar In 2022 Event Marketing Marketing Resources Event

The Average Cost Of Living In Myanmar Is 866 Which Is 1 11 Times Less Expensive Than The World S Average Compare Co In 2022 Cost Of Living Cool Countries City Pages

2022 Corporate Tax Rates In Europe Tax Foundation

Employments In Respect Of Which There Is A Shortage In Respect Of Qualifications Experience Or Skills Which Are Required For Skills Qualifications Occupation

Pin On Set Up Travel Services Business In Vietnam

A New Study Reveals The Most Popular Brands Across The Uk And Europe Vivid Maps In 2022 Europe Map Europe Fashion Brands

2022 Tax Inflation Adjustments Released By Irs

Tax And Financial Management Taxes Seaso Premium Photo Freepik Photo Background Business Money Text Tax Rules Financial Management Income Tax